30+ mortgage loan based on income

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Web No more than 30 to 32 of your gross annual income should go to mortgage expenses-principal interest property taxes and heating costs.

22 Mistakes Nearly All First Home Buyers Make Hunter Galloway

Web A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly.

. Web The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. Total 450 Monthly housing expenses. Web Low-income mortgages are loans tailored to address the issues that many low-income homebuyers face.

Were Americas Largest Mortgage Lender. Find all FHA loan requirements here. Total 4000 Monthly liabilities.

Web Get an estimated home price and monthly mortgage payment based on your income monthly debt down payment and location. For example some experts say you should spend no more than. Web Asset Based Mortgage.

Web Current limits are set at 115 of the areas median income. Web The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Web Thats why income for mortgage qualifying is always viewed in the context of your debt to income ratio or DTI.

Web The main benefits of an FHA loan include term options of 15 or 30 years a down payment as low as 35 and eligibility for those with a slightly lower credit score. Web When you apply for a mortgage loan your lender will give you a loan estimate that details your loan amount interest rate monthly payment and total loan costs. Web Most home loans require a down payment of at least 3.

Were not including any expenses in estimating the income. For a 250000 home a down payment of 3 is 7500 and a down. Ad Compare Mortgage Options Calculate Payments.

Compare Your Best Mortgage Loans View Rates. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Web 2 days agoThis as the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 726200 or less increased to 671 from 662 with points.

Compare Offers Side by Side with LendingTree. FHA Loan High Debt to Income Ratio Mortgage. Loans from 11 Months to 5 Years.

Debt low credit and the difficulty of saving a large down. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Web The Texas Mortgage Credit Certificate provides qualified borrowers with up to 2000 per year in a federal income tax credit based on mortgage interest paid in the tax year. An FHA loan is probably the most popular. Mortgage Rate 30-Year Fixed 3125.

Low Credit Scores Ok Minimal Docs Same Day Approval Closes in 5-7 Business Days. Lock Your Rate Today. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web 9 hours agoThe minimum loan amount is 1 above conforming limits and when you compare Optima Jumbo against High Balance loan scenarios in many cases Optima. Calculate interest rates on mortgage. Get Instantly Matched With Your Ideal Mortgage Lender.

Apply Now With Quicken Loans. Ad Calculate Your Payment with 0 Down. Ad Fast Same Day Approval at Competitive Rates.

For example the following are annual household income limits for popular areas around the country. Lets take a look at each option in depth. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Lock Your Mortgage Rate Today. Total 185 Qualifying Mortgage Amount for a Variety of Interest Rates Get your Rates. Ad Get the Right Housing Loan for Your Needs.

But our chase home. Ad Are you eligible for low down payment. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Your debt-to-income ratio is the percentage of pretax income that goes toward. Comparisons Trusted by 55000000.

Ad 10 Best House Loan Lenders Compared Reviewed. Web See how your payments change over time for your 30-year fixed loan term.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Is A 30 Year Fixed Rate Mortgage Rocket Mortgage

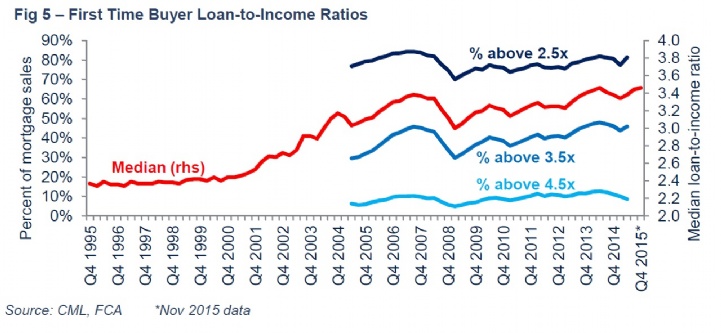

Savills Uk Household Debt

Feeding The City Impact Hub Berlin

How Much Home Can I Afford Hunter Galloway

30 Year Mortgage Rates Compare Us Rates

If The Ctc Is 32 Lpa What Is The In Hand Salary In India In 2022 Quora

Pv Warranty Insurance Backing Your Solar Investment Munich Re

How Much Can I Borrow For A Mortgage

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

30 Year Fixed Mortgage Pros Cons Comparison Calculator

30 Year Fixed Mortgage Rates Explained Assurance Financial

Today S 30 Year Mortgage Rates Fall To 6 5 Percent Jan 31 2023

24 Best Instant Personal Loan Apps In India March 2023 Moneytap

State Run Veteran Friendly Home Loan Programs

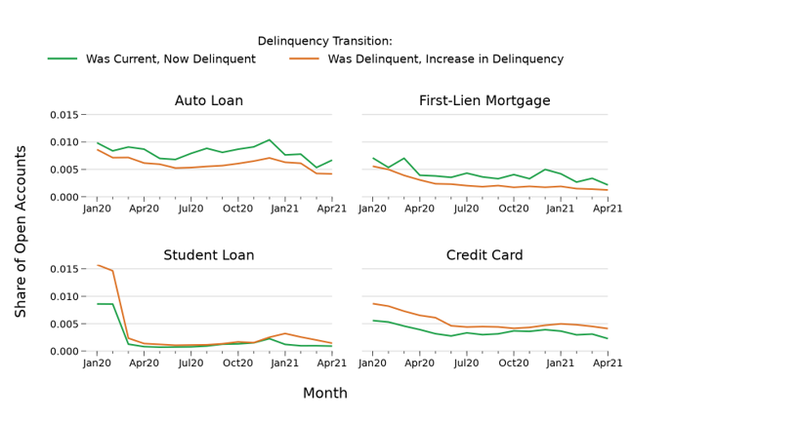

Delinquencies On Credit Accounts Continue To Be Low Despite The Pandemic Consumer Financial Protection Bureau

My Experience With Physician Home Loans Lifeofamedstudent