Tax depreciation schedule calculator

Our FREE on-line Depreciation Calculator goes through the same process as we do when clients phone for depreciation estimates. Depreciation value is the amount the.

Download Depreciation Calculator Excel Template Exceldatapro

MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS.

. Partner with Aprio to claim valuable RD tax credits with confidence. A tax depreciation schedule outlines all available depreciation deductions to maximise the cash return from your investment property or business each financial year. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book.

Anywhere the BMT. Start booking value which is the figure registered in accounting at the beginning of which year. Finally an accounting software you WANT to use easy beautiful.

All you need to do is. The schedule is presented on an annually basis. Gas repairs oil insurance registration and of course.

The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. MACRS Depreciation Calculator Help. Section 179 deduction dollar limits.

Above is the best source of help. You are provided with a Tax Depreciation Schedule that. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

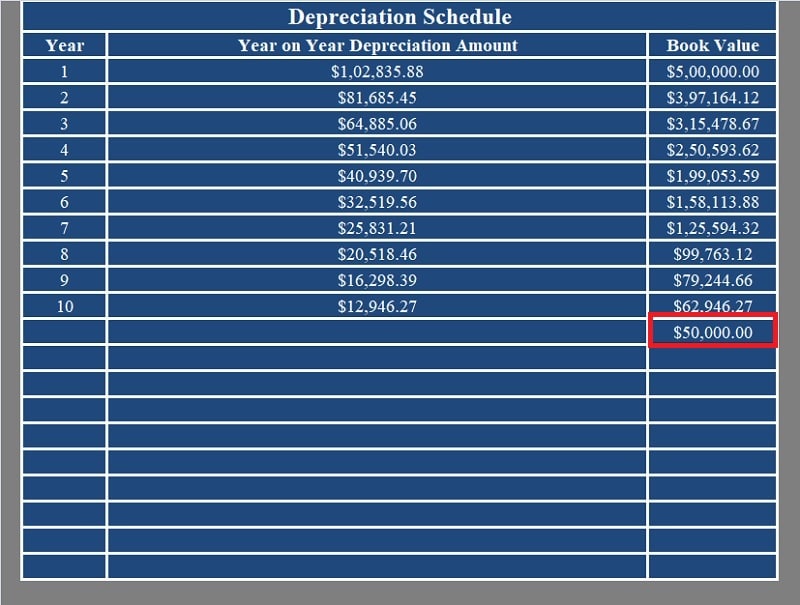

The tool includes updates to. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. The Depreciation Schedule is used to track the accumulated loss and remaining value of a fixed asset based on its useful life assumption.

The depreciation calculator above is provided as a general guide to allow you. This limit is reduced by the amount by which the cost of. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Depreciation is a non-cash expense that reduces the. Before you use this tool.

The workbook contains 3 worksheets. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. First one can choose the straight line method of.

The following methods are used. This depreciation calculator is for calculating the depreciation schedule of an asset. It will take just a few minutes to enter the information the.

It provides a couple different methods of depreciation. Calculator for depreciation at a declining balance factor of 2 200 of. A tax depreciation schedule is a comprehensive report that details the tax depreciation deductions you can claim on the value of these assets.

Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. The calculator also estimates the first year and the total vehicle depreciation.

Ad Get paid faster with electronic invoicing and automated follow-ups. A Tax Depreciation Schedule is prepared by a qualified Quantity Surveyor who calculates the available deductions for the property. Uses mid month convention and straight-line.

This calculator uses the same. An optimised tax depreciation schedule can increase your tax deduction for your property significantly. It is fairly simple to use.

Select the currency from the drop-down list optional Enter the. At Duo Tax our quantity surveyors can. This excel tool will calculate the depreciation expense of a tangible asset based on the selected depreciation method generating a depreciation schedule for the full term also.

It is not intended to be used for official financial or tax reporting purposes. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Depreciation Tax Shield Formula And Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator Straight Line Double Declining

Asset Depreciation Schedule Calculator Template

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Macrs Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Guide To The Macrs Depreciation Method Chamber Of Commerce

How To Prepare Depreciation Schedule In Excel Youtube

Free Macrs Depreciation Calculator For Excel

Automobile And Taxi Depreciation Calculation Depreciation Guru

Depreciation Schedule Formula And Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Formula And Calculator

Depreciation Schedule Formula And Calculator